40+ How much can i borrow va loan calculator

PMI will typically cost between 05 and 25 of your loan value annually. Often up to the.

Smarter Loans Review 2022 Comparewise

They can even apply for a new VA loan despite defaulting on a loan from years back.

. For today Tuesday September 13 2022 the current average 30-year fixed-mortgage rate is 610 rising 8 basis points compared to this time last week. Things to Consider When Taking Out a Loan. The loan is secured on the borrowers property through a process.

With so many ways to tailor your loan to. Click here to check todays low VA loan rates and see if you are eligible Sep 12th 2022 VA funding fee charts. To afford a 200K mortgage with a 20 down payment 30-year term and 4 interest rate youd need to make at least 38268 a year before taxes.

To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Based on 70 reviews.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The cons of a loan that lasts a decade longer has about 50 more total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount. The less you.

Pay back the loan as quickly as possible. Loan amounts range from 25000 to 150000 with terms of five to 20 years. A borrower can have 2 VA loans at the same time.

Based on 6 reviews. Borrow Little Repay Quickly. Your chances of getting approved for a personal loan are much higher.

This page is for personal non-commercial use. It usually takes just one to three days and can be done online or over the phone. How much you ultimately can afford depends on your down payment loan terms taxes and insurance.

Remember that lenders will still impose a maximum amount you can borrow often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan. With each subsequent payment you pay more toward your balance.

As of March Fed policymakers saw inflation drifting down to 43 percent later this year though that was before the Department of Labors consumer price index CPI showed that prices rose to a. You may order presentation ready copies to distribute to your colleagues customers or clients by visiting https. We assume homeowners insurance is a percentage of your overall home value.

Nearly 35 percent of respondents in 2022 said they would need to borrow the money for such a surprise expense and 49 percent indicated inflation is holding them back from saving money. Can I afford a 360k house. This is done through the VA streamlined interest rate reduction refinancing program.

Qualified borrowers are also allowed to refinance to a lower rate or shift to an adjustable rate mortgage or fixed-rate loan. While a longer-term loan will mean a lower monthly cost the longer the lifetime of the loan is the more that you will pay in interest. Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score down payment and length of your loan.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Loan repayment terms can range from 24 to 84 months. Todays national mortgage rate trends.

How much do I need to make to afford a 200000 house. Certain loan types such as USDA and VA loans do not require a down payment. Based on 40 reviews.

Depending on the figures that you enter into our Loan Early Repayment Calculator. Census Bureau stated that the median price of a home in the United States was 321500 in 2019 while the average price was 383900. This will save you money and will stop you from getting in any financial trouble.

Borrow money from family or friends. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property. When you take out a mortgage you agree to pay the principal and interest over the life of.

How much can you borrow. Ultimately how much you need to make depends on your down payment loan terms taxes and insurance. T he charts below show VA loan funding fee amounts for different borrowers.

Veterans Affairs backs VA loans. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. Why BMO Harris Bank is the best home equity loan for different loan options.

We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. How Much of a Mortgage Can I Afford. If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example.

The following table shows loan balances on a 200000 home loan after 5 10 15 20 25 30 35 40 years for loans on the same home. If you live in large metropolitan areas like New York San Francisco or Los Angeles you can expect to pay significantly more. Up to 31000 for dependent undergraduates up to 57500 for independent undergraduates up to the full cost of attendance for graduates Varies by lender.

VA home loans are exclusively given to active military members veterans and. If a friend or. We use current mortgage information when calculating your home affordability.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. VA home loan applicants can pay all or part of the fee in cash or roll the fee into their loan amount to reduce out-of-pocket expenses at loan closing. Buying a home can be expensive.

Based on 8 reviews. So with a 20 down payment on a 30-year mortgage and a 4 interest rate youd need to make at least 90000 a year before tax.

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

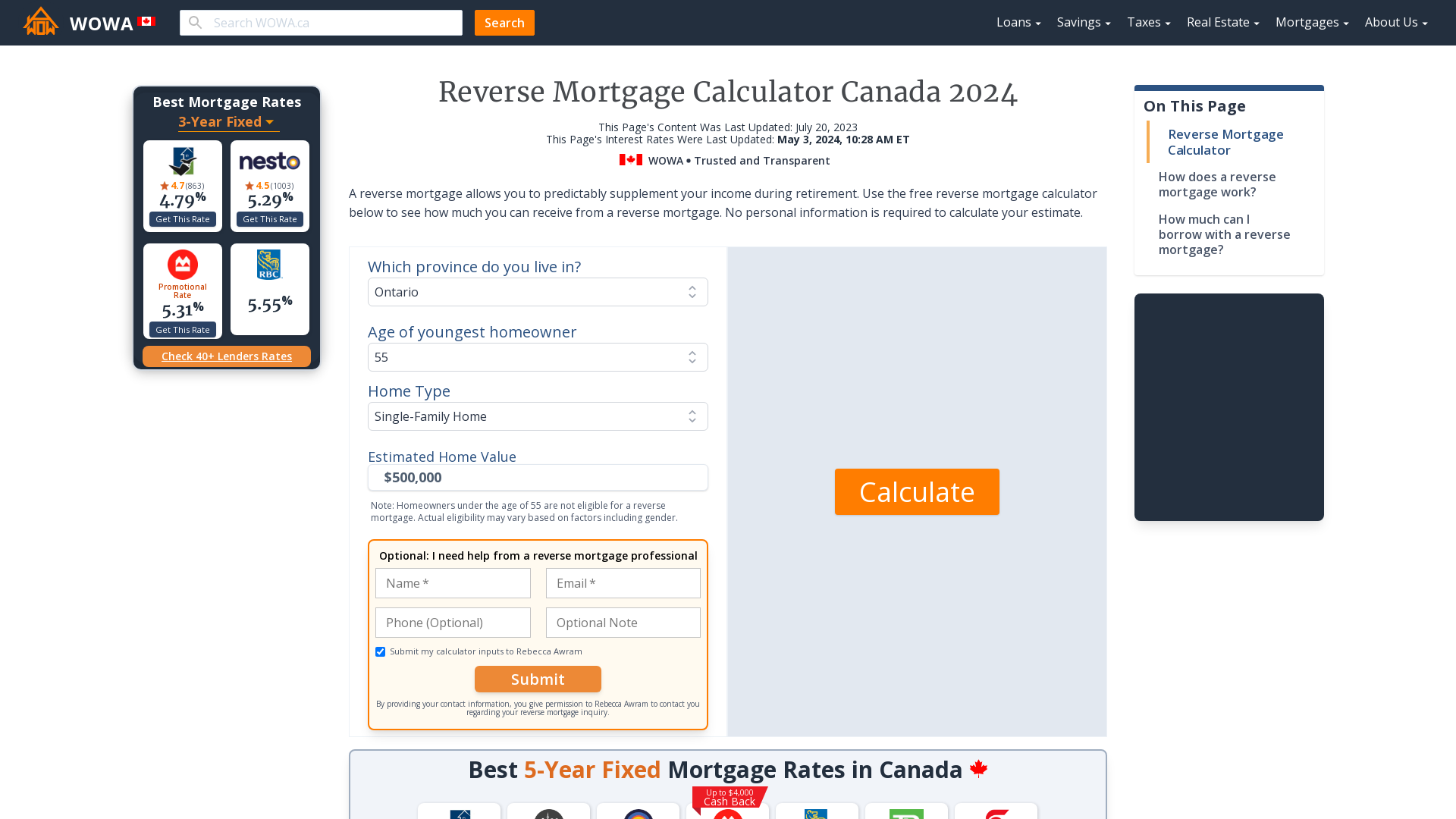

Reverse Mortgage Calculator Canada No Personal Info Required Wowa Ca

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

How To Use A Mortgage Calculator Comparewise

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

10 Best Instant Payday Loans With No Credit Check Get Online Cash Advance For Bad Credit 2022

How To Calculate Mortgage Payment In Microsoft Excel Quora

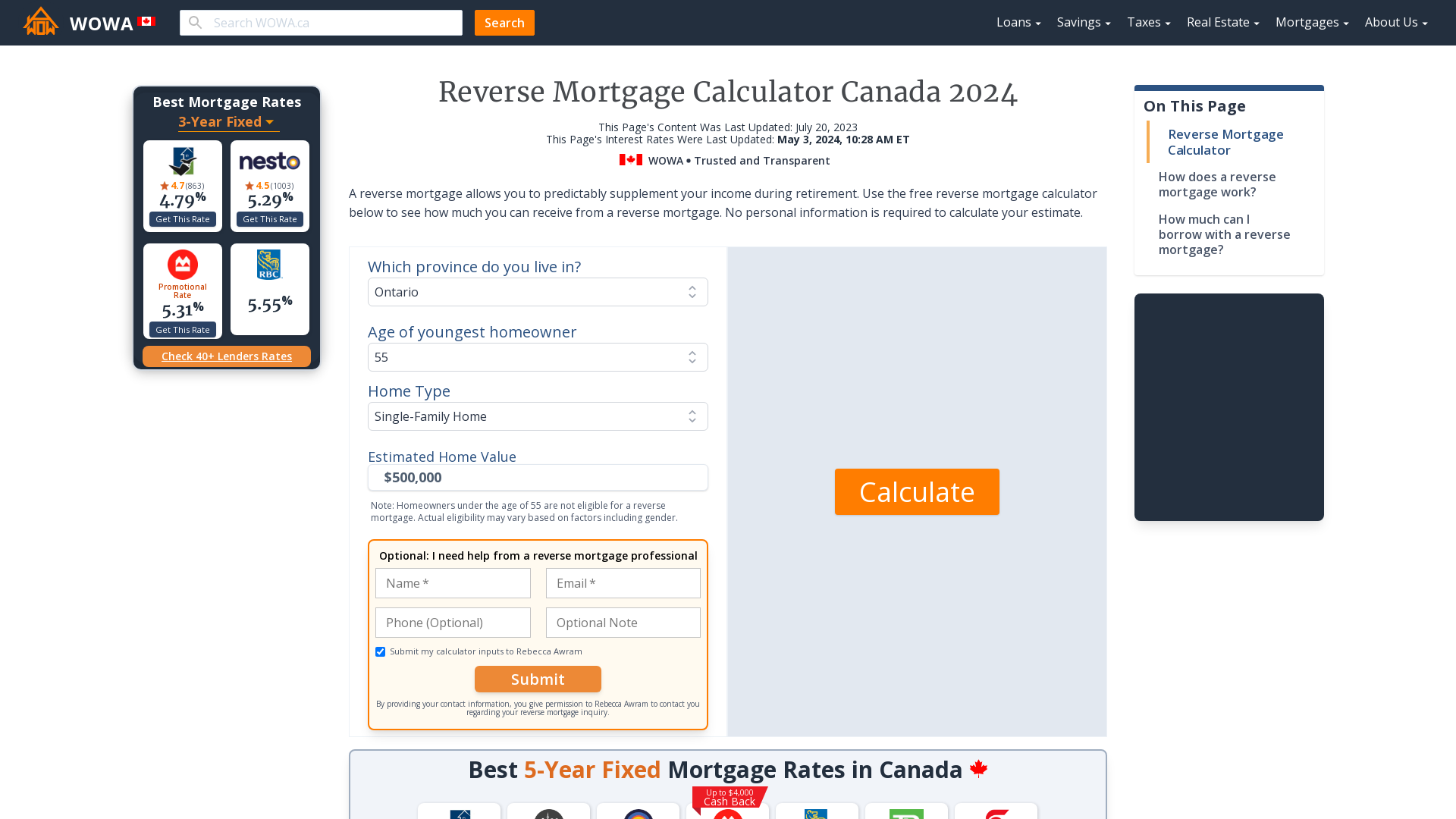

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

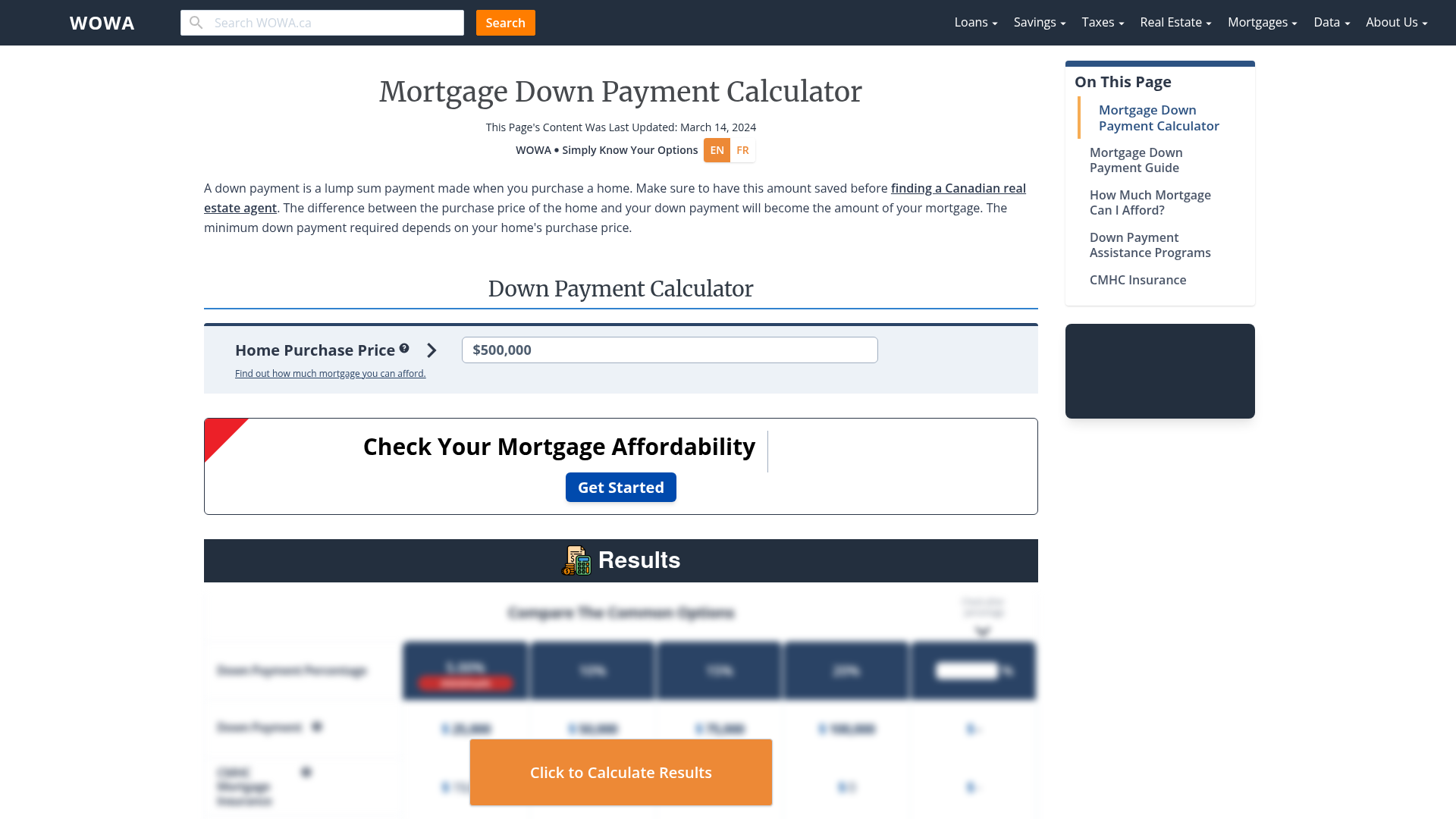

Second Mortgage Calculator Qualification Payment Wowa Ca

How Low Are Mortgage Interest Rates In Japan Compared To The United States Blog

Private Mortgage Calculator 2022 Wowa Ca

Ykyn2lcfj1k0wm

Heloc Calculator Calculate Available Home Equity Wowa Ca

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

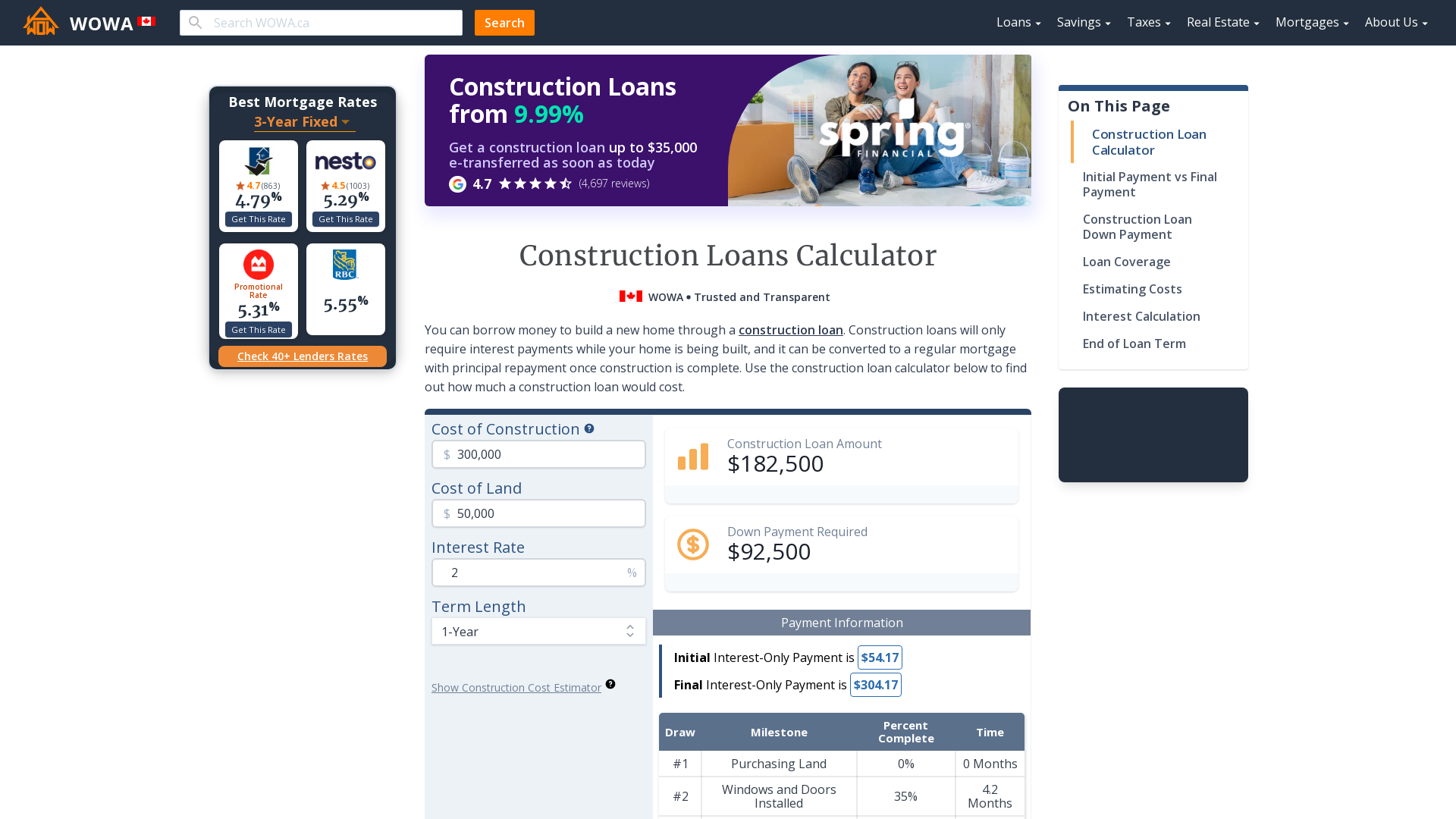

Construction Loan Calculator For Canadian Builders Wowa Ca